Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

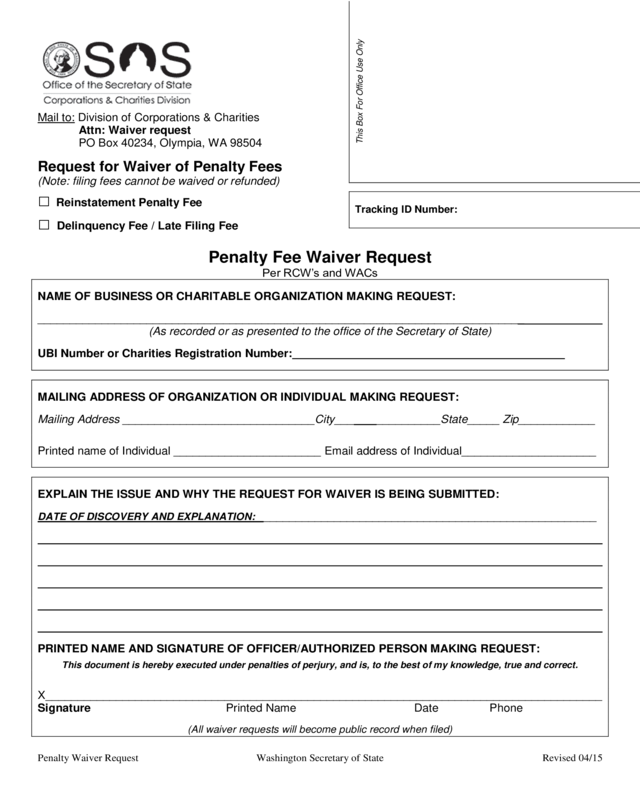

Request To Waive Penalty : Penalty Waiver Policy Pdf Free Download - A penalty exemption will be granted if reasonable cause exists.

Request To Waive Penalty : Penalty Waiver Policy Pdf Free Download - A penalty exemption will be granted if reasonable cause exists.. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Penalties can be waived because of a request can be sent for: Don't forget to request abatement timely before the statute expires: Now that you've gotten your tax documents together, you can call the irs to ask for a tax penalty waiver. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty.

Taxpayers can request abatement of penalties within the normal refund statute of limitations which is 3 years from the date the return was filed or 2 years after the penalty was paid. Search for irs tax penalty waiver at topsearch.co. You also are getting a waiver on the penalty itself rather than the taxes you owe. Requests must be in writing. If you have reasonable cause, we may waive penalties.

Now that you've gotten your tax documents together, you can call the irs to ask for a tax penalty waiver.

Serious illness, death, fire, natural disaster, or criminal acts against you. Penalty abatement is an administrative waiver that the irs gives to people who miss a tax payment. You should submit a request in writing with the late return and tax payment. Reduced or waived, interest associated with the penalty will also be reduced or waived. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations, due to circumstances beyond your control. The irs will not offer them to you, even if you qualify. Search for irs tax penalty waiver at topsearch.co. To request that a tax penalty be waived, the taxpayer would be required to write a penalty abatement letter to the irs to make this request. Reasonable cause may exist when you show that you used ordinary business care and prudence and. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. This is due to the reason that i was not able to pay on time because our company had a financial problem. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. Please attach documentation to support your request if it is available.

Please attach documentation to support your request if it is available. Don't forget to request abatement timely before the statute expires: During the time it takes for my team to process each request, no additional penalties, interest, costs or fees will be imposed on the property tax. This is due to the reason that i was not able to pay on time because our company had a financial problem. Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay timely.

Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty.

You do not need to take any additional action. If you received a notice, be sure to check that the information in your notice is correct. How to request a penalty waiver if you haven't already added your client to your account, do so now. Here is a sample letter to request irs penalty abatement. Check out results for irs tax penalty waiver For the employment development department (edd) to waive the penalty, the employer must establish that good cause or. Visit letters for information about specific notices. Reasonable cause may exist when you show that you used ordinary business care and prudence and. If you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. If you have reasonable cause, we may waive penalties. The irs will not offer them to you, even if you qualify. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. Unsecured property tax penalty waiver request.

How to request a penalty waiver if you haven't already added your client to your account, do so now. In the past, the irs has sometimes allowed abatements past the refund statute expiration date. Request to waive penalty.i am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position.

Penalty abatement is an administrative waiver that the irs gives to people who miss a tax payment.

If your situation fits any of these reasons then you may be entitled to a penalty abatement simply by asking the irs for the abatement. How to request a penalty waiver if you haven't already added your client to your account, do so now. For the employment development department (edd) to waive the penalty, the employer must establish that good cause or. If your return payment is late and you feel you have a qualifying situation, you may request consideration for a penalty waiver. To request a waiver of penalty due to reasonable cause, write to us at the address on the notice you received and provide a detailed explanation of your current circumstances and any documentation that supports your position. Check out results for irs tax penalty waiver Search for irs tax penalty waiver at topsearch.co. This is due to the reason that i was not able to pay on time because our company had a financial problem. I hope for your kindness and consideration to grant this request. Penalty may be waived on an assessment if you can show reasonable cause for your failure to pay timely. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. If you received incorrect oral advice from the irs, you may qualify for administrative relief.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Gravillo Mignonette Lavé - Gravillon Mignonette Point P : Gravier mignonette 4 10 en big bag 750 kg leroy merlin gravier mignonette 4 10 en big bag 750.

- Dapatkan link

- X

- Aplikasi Lainnya

Gaji Pekerjaan Mengisi Uang Di Atm / Mengenal Komponen Gaji Pekerja - News & Events ... : Butuh uang tinggal ke atm hiduup bebaaaaasssss !!!!

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar